Finomis provides you with the Financial Planning services that analyze your financial health to the key stroke level and helps you to plan your investments in order to meet your goals. As a part of financial planning, we extend services like recommendations on your current portfolio, restructuring of current loans and advices on tax optimization. Being well versed in grasping and analyzing your financial requirements, we help you to build better plans and strategies, thereby to reach the important milestones in your life, and that best differentiate us from our peers.

Our Financial Planning process is designed as

To get a complete awareness of your needs

To develop customized plans of investments that enables you to reach your goals.

Strengthening the client-Finomis relationship by our active engagement through constant communication.

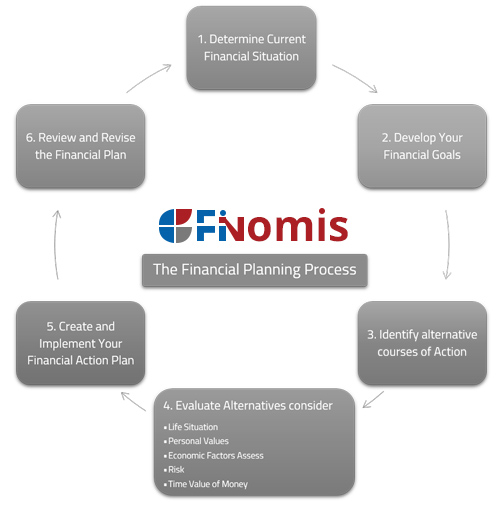

Defining your needs and aspirations is among the most important tasks in Financial Planning. It starts from assessing your current financial status. Finomis follows a clear 6-step process to guide you in reaching your milestones as shown below

Wealth Planning Services

Wealth Planning is the process of arriving at a plan that aims to protect and preserve your wealth and at the same time transferring it to your intended beneficiaries by reducing legal and other estate settlement expenses.

As a group, Finomis has been helping some of the most exceptional people to protect and preserve their wealth and plan for the wellbeing of future generations. Whether you are preparing for protection or inter generation transfer of wealth, our highly qualified team of Wealth Planners, together with specialist law firms and tax and trust experts, facilitate formulation of an effective solution tailored to your specific needs.

Trust & Estate Planning

Making a will is easy. Making sure it gets executed the way you intended is the tricky part. Only professional, expert estate planning will ensure that your estate is in order and that your loved ones are taken care of in the best possible way. A team, comprising of banking, investment and legal experts will craft personalized estate plans to manage and transfer your assets in the most tax-efficient way possible. So that your will gets executed without any hassles or unpleasant disputes.

The estate planning services encompass:

Wills

Formulating the will as per client’s specific requirements and the applicable laws

Video recording the entire process, if so desired

Safe-keeping of the will

Provision of storing the final will in physical form and E-form

Executorship

Trusts

Preparation (Counseling and Drafting) of a trust deed

Legal and regulatory management

Discharge obligations on behalf of the trust

Distribution of assets to the beneficiaries

Executorship

Asset identification

Protecting business interests

Long term financial success does not happen by accident nor will it happen on its own. It requires customized planning and frequent review that only comes from the services of a competent and unconflicted wealth solution provider.

Contact us to schedule a free, no obligation introductory consultation.

Need Help?

|

0495 4050900 |

|

+91 9497 881 122 |

|

info@finomis.com |

|

care@finomis.com |